Monzo Bank: My experience so far using Monzo

Random Article

Monzo Bank: My experience so far using Monzo

In my preparation, to become a digital nomad I have been thinking about banking. I know exciting right.

From my reading, some banks can charge extortionate rates to use your card abroad. That just won’t do if I will be travelling abroad, so really I need to find a bank that can give me zero fees.

That’s why I have chosen Monzo Bank.

I first heard about Monzo from a friend who had just signed up. She travels a fair bit and we were talking about the cost of her using HSBC abroad, and it turns out it can be extortionate! She joined for the 0% but it’s not her main account.

I did a little research before signing up so here is what I found and here is a little of my experience so far using Monzo. This is not a fully complete article and I have yet to go full nomad so please bear that in mind.

Monzo Bank: I’ve never heard of it!

Most people haven’t. It’s pretty brand spanking new. It was originally set up as Mondo but there were some trademarking issues so it changed its name to Monzo – an all round better name I think.

Monzo is a UK bank. It was founded in 2015 as a startup.

In February 2016, it did some crowdfunding. Which was an absolute success raising £1million in 96 seconds! Blimey that is fast!

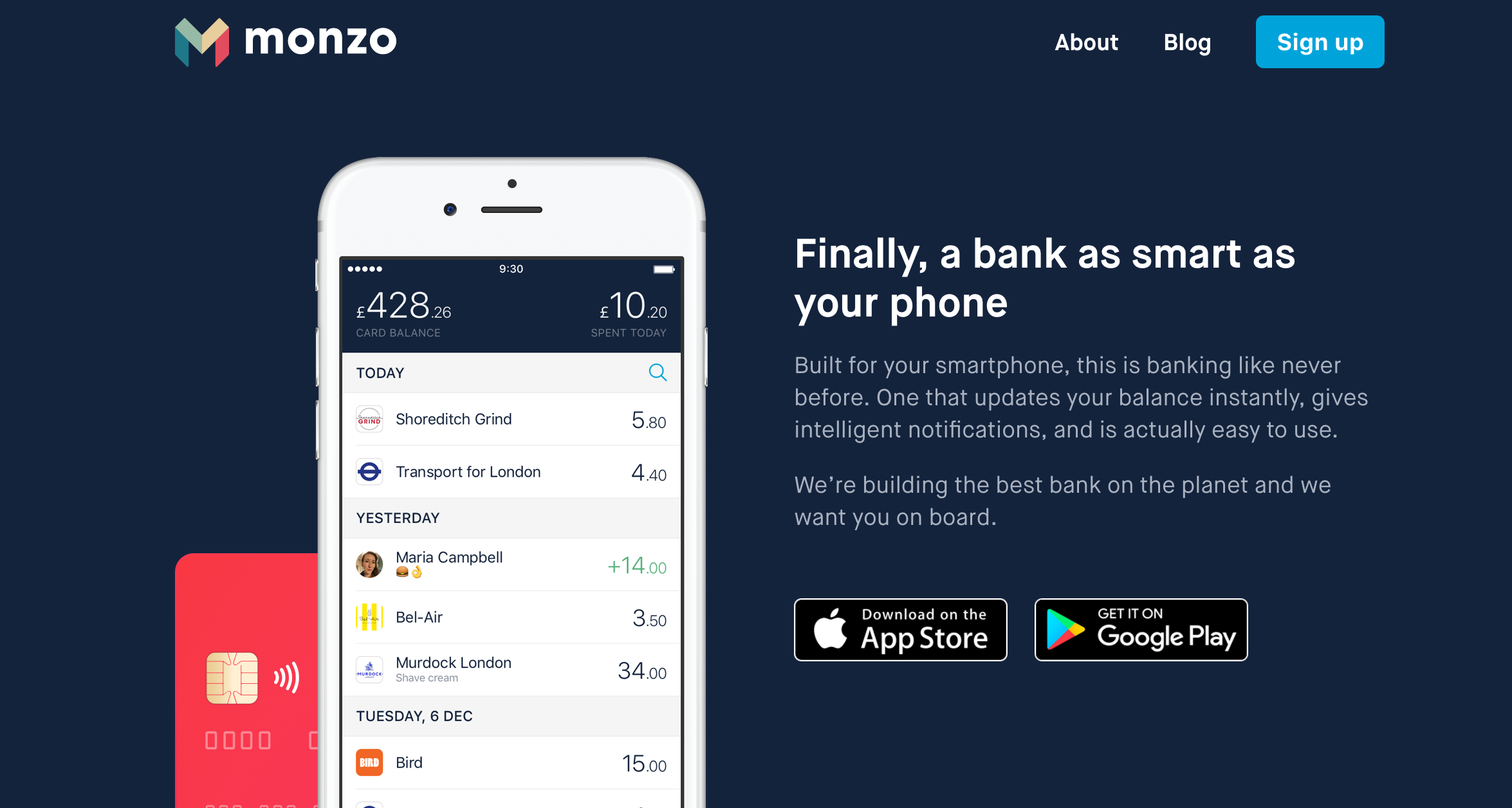

Monzo, itself is not your usual high street bank, it is a digital mobile-only bank. It won’t suit everyone but it will suit a certain demographics who want a different type of bank experience.

What does Monzo do?

Monzo does some things that tradition high street banks do and a few things that they don’t do. Here is my list (it’s not a complete list but I think it covers the key parts):

- Pre-paid Mastercard debit card. You get this pretty much in the first two weeks of your joining. You just need to load £100 onto the card and you are good to go. It is a contactless card with chip and pin so you can use it straight away. It is recommended that you have a backup card as the Monzo card is currently only in beta.

- Real-time transaction notifications. This is probably my favourite part of Monzo so far. You get real-time access to the money you spend and receive on your iPhone or Andriod app. The app, by the way, is beautiful!

- Instantly freeze and unfreeze your card. You can freeze and unfreeze your debit card straight from the Monzo app. This is great if you have misplaced or lost it, and if you do find it again, you can unfreeze it at the click of a button.

- Spending categorisation and breakdown. Another great feature is that the app will segment your spending by type. This is great to track your spending habits. Also, you can add monthly budgeting targets – this is not something that I have yet done but I think this will be really useful for every digital nomad.

- Zero fees, even abroad. This will get every single digital nomad jumping for joy! Who doesn’t love 0% transaction fees!

What Monzo wants to do?

Monzo is really new so many features just won’t have been rolled out, or even planned yet, but here are some of the things that the bank would like to do in the future:

- Bank account – account numbers and sort codes. As Monzo is restricted under its banking licence, it current doesn’t have the permission or ability to issue actual bank accounts. Therefore you won’t get a bank account, a bank account number, or a sort code. Well, not yet anyways. It is something they are working on.

- Direct debits and standing orders

- FSCS Protection

- Quick, easy overdrafts

What won’t Monzo do?

Monzo also won’t do some things that traditional banks do. Here’s a short list:

- No cheques. Monzo won’t issue cheque books. If that is an issue for you then Monzo is definitely not a good fit. For me, and it’s target market, cheques are obsolete.

- No branches. You won’t be able to walk into your local Monzo branch. To be fair, I can’t remember the last time I walked into a bank branch for my current high street bank accounts.

Is it a good fit for a digital nomad?

This is a hard one to answer as I’m not a digital nomad and I have yet to test it abroad. I have signed up and I have tested it here in London.

My experience so far has been pleasant. Twice the card failed to work so I had to fall back to my usual card. I enjoy getting the notifications of my spending. Those help me to be more aware of my actual spending which is always a good thing. Contactless has become far too easy to use and spend, spend, spend. A handy notification is always a good reminder that money doesn’t grow on trees – and eats away at my savings.

For now I will continue to try it out and try it out on my short trips before going full nomad.

It’s worth signing up to see what all the fuss is about and see if it is a good fit for you.

Comments

Take part in the discussion

Discussion about Monzo Bank: My experience so far using Monzo article, if you have any questions, comments or thoughts then get leave a reply.